ad valorem property tax florida

Florida property taxes are relatively unique because. The most common ad valorem taxes are property taxes levied on real estate.

Understanding Your Tax Notice Highlands County Tax Collector

Ad valorem means based on value.

. Florida Statute 200001 provides a more detailed breakdown of the millage rate categories. Ad valorem taxes may be increased at a greater rate only with a super majority or unanimous vote of the local government governing body. Opry Mills Breakfast Restaurants.

When someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent the property owner may be eligible to receive a homestead exemption that would decrease the propertys taxable value by as much as 50000. Ad Valorem taxes on real property and tangible personal property are collected by the Tax Collector on an annual basis beginning on November 1st for the calendar year January through December. Ad Valorem Taxes Real property is located in described geographic areas designated as parcels.

It is the responsibility of each taxpayer to ensure that hisher taxes are paid and that a tax bill is received. 4 if paid in November 3 if paid in December 2 if paid in January 1 if paid in February. The Ad Valorem tax roll consists of.

2 a 3 cap on the annual increase in the ad valorem tax value of the home. The non-ad valorem assessment is levied for the first time. Taxes on all real estate and other non-ad valorem assessments are billed collected and distributed by the Tax Collector.

All owners of property shall be held to know that taxes are due and payable annually before April 1 st and are charged with the duty of ascertaining. The Florida Homeowner Assistance Fund may be able to offer you relief for mortgage payments and other homeowner expenses. Ad Valorem Property Tax Florida.

2 the duty. The ad valorem taxes are based on a calendar year January 1st to December 30th and are paid in arrears. For more information visit DORs website.

However the Chamber of Commerce fought back successfully winning back their exemption from the First District Court of Appeals. Florida Department of Revenue. Real property is located in described geographic areas designated as parcels.

Taxes usually increase along with the assessments subject to certain exemptions. Register now to begin the first step of determining your eligibility to participate in the program. Authorized by Florida Statute 1961995 this incentive provides an exemption of up to 10 years from the property taxes both real property taxes and tangible personal property taxes payable with respect.

Section 197122 Florida Statutes charges all property owners with the following three responsibilities. It includes land building fixtures and improvements to the land. Railroad taxes Real estate taxes Tangible personal property taxes Property Assessment The property appraiser assesses the value of a property and the Board of County Commissioners and other levying bodies set the millage rates.

The Property Appraiser establishes the taxable value of real estate property. Floridas ad valorem statute allows tax exempt entities to be exempt from real property taxes when the property they own is being used to provide affordable rental housing as affordable housing is a charitable use. A permanent resident of Florida that owns his or her principal residence in Florida qualifies for 1 a 50000 exemption and an additional 50000 exemption if the owner is age 65 or older from the value of the property for ad valorem tax purposes.

Recently Alachua County denied a longstanding exemption from the Gainesville Area Chamber of Commerce which had been previously operating under an ad valorem property tax exemption for charitable purpose. 3 portability of an under-assessment the amount by which. A Household goods means.

Are Dental Implants Tax Deductible In Ireland. These tax statements are mailed out on or before November 1st of each year with the following discounts in effect for early payment. An ad valorem tax is a tax based on the assessed value of an item such as real estate or personal property.

Application to be filed not later than March 1 DR-418 R. Income Tax Rate Indonesia. Ad Download Or Email FL DR-418 More Fillable Forms Register and Subscribe Now.

Tangible Personal Property Taxes are an ad valorem tax assessed against furniture fixtures and equipment located in. There are two types of ad valorem property taxes in Florida which are Real Estate Property and Tangible Personal Property. In Florida property taxes and real estate taxes are also known as ad valorem taxes.

FLORIDA COMMUNITY LAND TRUST INSTITUTE PRIMER A PUBLICATION OF THE FLORIDA HOUSING COALITION 62. Officer charged with the collection of ad valorem taxes levied by the county the school board any. Using these figures the property appraiser prepares the tax roll.

ECONOMIC DEVELOPMENT AD VALOREM PROPERTY TAX EXEMPTION Chapter 1961995 Florida Statutes To be filed with the Board of County Commissioners the governing boards of the municipality or both no later than March 1 of the year the exemption is desired to take effect. Ad Valorem based on value taxes for Real Property and Tangible Personal Property are collected by the Tax Collector on an annual basis beginning on November 1st for the tax year January through December. Taxes are assessed by the Property Appraiser as of January 1 of each year and levied in Hillsborough County by the taxing authorities.

This exemption qualifies the home for the Save Our Homes assessment limitation. It includes land building fixtures and improvements to the land. 1962002 Florida Statutes This application is for ad valorem tax exemption under Chapter 196 Florida Statutes for organizations that are organized and operate for one or more of the following purposes.

1 the knowledge that taxes are due and payable annually. Complex tax appeals before the value adjustment boards and in circuit court throughout Florida Ad valorem property tax exemptions and classifications including agricultural classifications Property tax projections and tax planning Asset allocations of acquisitions Economic incentives Historic preservation tax credits. Both reports must contain the necessary data elements and use the format that the Department prescribes.

4 a A local government shall adopt a non-ad valorem assessment roll at a public hearing held between January 1 and September 15 or between January 1 and September 25 for any county as defined in s. Majestic Life Church Service Times. AD VALOREM TAX EXEMPTION Application APPLICATION AND RETURN Sections 196195 196196 196197 1961978.

One valuable tax break which is available in a number of Florida counties and cities is the Economic Development Ad Valorem Tax Exemption. The tax roll describes each non-ad valorem assessment included on the property tax notice bill. Non Ad Valorem Assessment is a charge or a fee not a tax to cover costs associated with providing specific services or benefits to a property.

The summary report shows the number of parcels assessed and the total taxes levied for that taxing district. Check all that apply. The greater the value the higher the assessment.

Personal property for the purposes of ad valorem taxation shall be divided into four categories as follows. Property Tax Oversight Program. Restaurants In Matthews Nc That Deliver.

Soldier For Life Fort Campbell. Download Or Email FL DR-418 More Fillable Forms Register and Subscribe Now. The maximum tax levy allowed by a majority vote of the governing body is based on the rate of growth in per capita personal income in Florida.

2019 Florida Property Tax Appeal Deadlines Are Approaching Firstpointe Advisors Llc

A Guide To Your Property Tax Bill Alachua County Tax Collector

Real Estate Property Tax Constitutional Tax Collector

Free Form Dr 462 Application For Refund Of Ad Valorem Taxes Free Legal Forms Laws Com

Form Dr 462 Download Printable Pdf Or Fill Online Application For Refund Of Ad Valorem Taxes Florida Templateroller

Citrus Property Values And Estimated Ad Valorem Taxes Levied In Florida Download Table

Appealing Ad Valorem Tax Assessments Johnson Pope Bokor Ruppel Burns Llp

Tax Prorations Explained For Florida Real Estate Closings Part 2

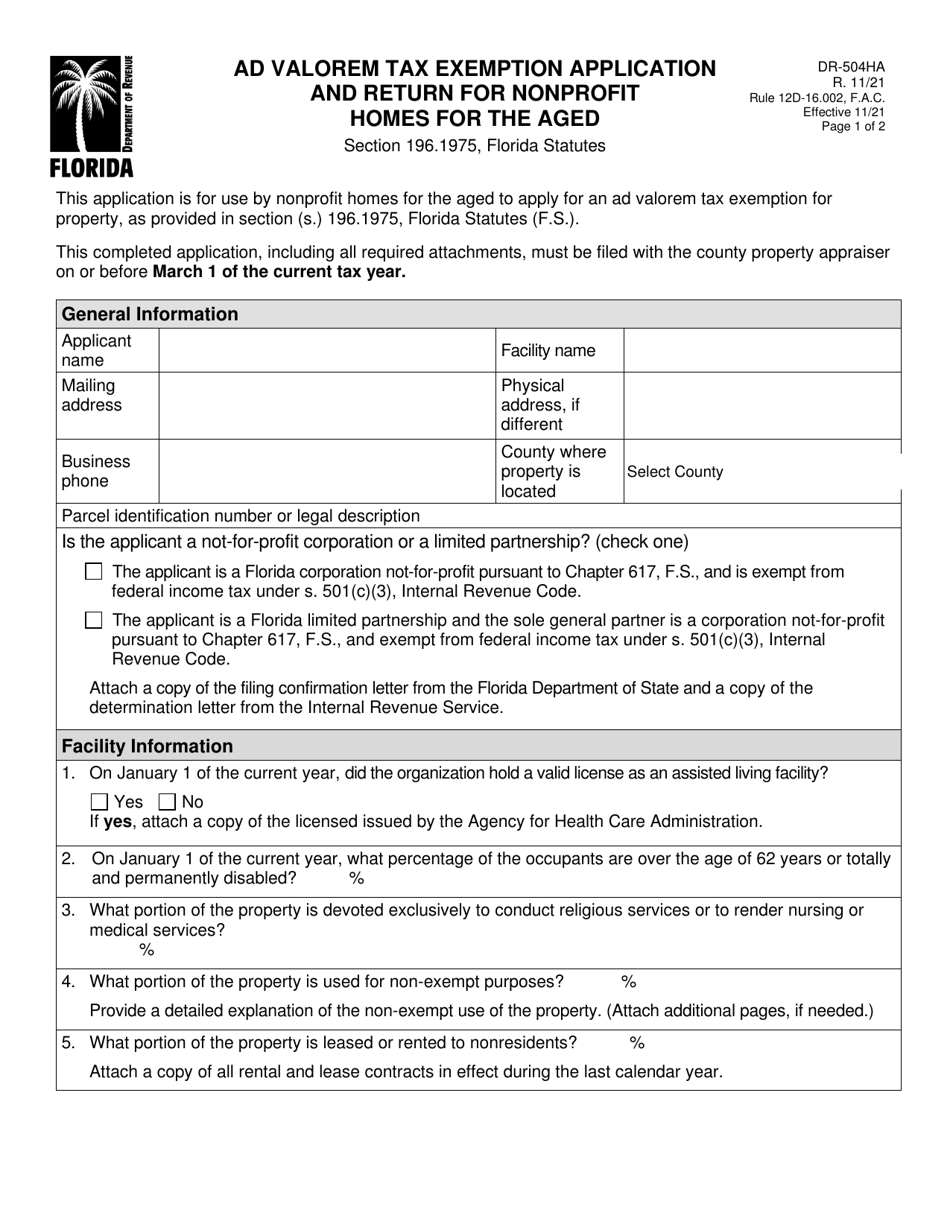

Form Dr 504ha Download Fillable Pdf Or Fill Online Ad Valorem Tax Exemption Application And Return For Nonprofit Homes For The Aged Florida Templateroller

An Investment In Knowledge Always Pays The Best Interest Floridatitlecompany Realestateattorney Www Marinatitle Com Investing Estate Lawyer Real Estate

Real Estate Taxes City Of Palm Coast Florida

What Is This Trim Notice I Received From The Property Appraiser Lubin Law Property Tax Appeals South Florida

Broward County Property Taxes What You May Not Know

Form Dr 504cs Download Fillable Pdf Or Fill Online Ad Valorem Tax Exemption Application And Return For Charter School Facilities Florida Templateroller

2018 Florida Property Tax Appeal Deadlines Are Approaching Firstpointe Advisors Llc

Understanding Your Tax Bill Seminole County Tax Collector

Property Tax Page Bluehome Property Management

Do Not Miss Your Opportunity To Save It Is Due By March 1st The Florida Homestead Exemption Reduces The Taxable Va Miami Realtor Miami Real Estate Florida Law